Back in 2011, the Nigerian government set an ambitious mission: to bring financial inclusion to 80% of its people by 2020. While this was a big dream, it’s important to acknowledge that by the end of 2020, it wasn’t fully achieved. Fast forward to 2022, EFINA, a think tank backed by the UK’s FCDO, tells us that a substantial 38.1 million adults in Nigeria still don’t have access to basic financial services.

At Remita, we are committed to contributing our part to make financial inclusion a reality for more Nigerians. While we may not have hit the exact mark set in 2011, the journey towards greater financial inclusion continues. Let’s keep working together, recognizing the challenges and opportunities that come our way, to make financial services more accessible and friendly for all Nigerians.

Financial inclusion, in its most welcoming and inclusive form, means ensuring that everyone, no matter who they are – whether young or old, rich or not, from cities or villages – can access important financial services. It’s about making things like savings, loans, insurance, and payments available to everyone, especially those with less money who might not know how to get these services easily.

In Nigeria, think of your grandmother in a quiet village having her own bank account or a farmer walking into a bank to get money for their farm. Imagine a small trader getting paid through their phone instead of just using cash.

While it’s true that these opportunities aren’t everywhere in Nigeria yet, it’s great to see that we’ve made progress in giving more people a chance. And there’s always more room for friendly and inclusive growth.

Some key challenges in Financial Inclusion include but are not limited to:

- Low Financial Literacy: Many rural residents in Nigeria lack financial knowledge, making it challenging to include them in the financial system. Both customers and service providers often struggle with understanding financial services, hindering effective education and awareness campaigns.

- High Inflation Rates: Double-digit inflation rates erode the real value of savings, discouraging people from saving money. This leads to a preference for non-bank savings alternatives.

- Persistent Poverty: Despite economic growth, poverty remains a significant challenge in Nigeria, and unemployment rates continue to rise, limiting people’s ability to participate in financial inclusion initiatives.

While efforts have been made by the Central Bank of Nigeria and deposit money banks to enhance financial inclusion, these fundamental issues need to be addressed for substantial progress to occur.

source: occasional paper no. 45 issues and challenges

Expanding access to financial services carries immense benefits for a country’s economy. It simplifies the process of saving money and making smart investments. However, financial inclusion goes far beyond merely having a bank account; it’s about ensuring that everyone, particularly those typically underserved, can readily tap into these services.

Financial inclusion plays a pivotal role in addressing various challenges faced by both individuals and businesses. It aids in overcoming the following hurdles:

- Provision of several payment options.Creation of budgeting and savings applications that match how people earn and spend money with the right saving options.

- Making funds transfer a simple and seamless experience.

- Providing insurance options, both for life and other things.

In the end, financial inclusion is like giving everyone a fair shot at building a better financial future.

At Remita, we believe that financial inclusion is the cornerstone of financial empowerment. It’s the key to providing individuals and businesses with the tools they need to construct a more secure and prosperous future. With our solutions, we’re committed to not only expanding access to financial services but also making them more accessible and user-friendly, ensuring that everyone can participate in the journey toward a brighter financial tomorrow.

In the realm of technology, achieving financial inclusion in smaller towns and cities poses a significant challenge. However, at Remita, we recognize the importance of embracing technology to bridge this gap by providing the right types of financial services.

Our commitment begins with deploying robust Core Banking Solutions (CBS) that can handle the volume and variety of services required to serve low-income and rural populations effectively. We don’t stop there; we prioritize a multi-channel approach that includes handheld devices, mobiles, and micro-ATMs known as POS terminals. These channels seamlessly integrate with our (linking article required)[Remita Agency Banking Platform], ensuring accessibility and convenience for all.

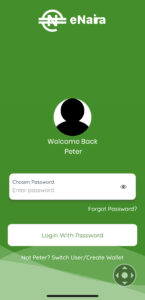

Here’s something truly exciting – Remita’s digital payment option, known as eNaira. It’s not just a payment method; it’s a game-changer! Remita is at the forefront of digital currency payment in Nigeria, via the Central Bank Digital Currency (CBDC), thanks to our groundbreaking eNaira platform. With eNaira, you can effortlessly transfer naira as an electronic asset to fund your preferred wallets or accounts.

This innovative platform is a result of our forward-thinking approach, drawing inspiration from cutting-edge Web 3 technology concepts such as blockchain innovations. It’s a testament to how Remita consistently delivers adaptable solutions that seamlessly bridge the gap between the future and current practical use cases.

We’re not just keeping up with the times; we’re shaping them with user-friendly innovations that empower you to manage your finances in the digital age.

Check out our CEO/MD, DRM, in this quick video snippet explaining how one of our awesome technologies is making payments faster and safer through contactless payment using NFC and RFID technology.

“Contactless which is an extension of cashless will be the engine of Retail growth because of the convenience it provides to end users. The real goal of Financial Inclusion will be achieved if we’re able to leverage contactless. At Remita, we have only one job: making payment easy !”

-DRM (MD/CEO, RPSL)

At Remita, we are wholeheartedly committed to this vision, contributing to a financially inclusive Nigeria while ensuring the growth and development of all stakeholders.

In a friendly wrap-up, Remita is your trusty guide on the exciting journey towards financial inclusion in Nigeria. We’re not just a follower; we’re a trailblazer. We make sure that financial services are easy to access, no matter who you are or where you come from.

Our eNaira platform is a great example of how we’re using the latest tech trends to make money management a breeze. We don’t just talk about the future; we make it happen right now.

So, whether you’re a grandma in a village or a tech-savvy city dweller, Remita is here to ensure you’re included in the financial world. We’re not just about money; we’re about making your financial future brighter and friendlier….” because payment should be easy!“