By Uchenna Okpagu, Chief AI Officer at Remita

Introduction

Generative AI has rapidly transformed various sectors, from healthcare to finance, education, and beyond. Its applications are becoming an integral part of our daily lives. In this article, I will be sharing how Remita has harnessed the power of Generative AI to elevate user experiences, enhance fraud detection, improve internal operations, expand business insights, and accelerate integrations across our partner network.

Remita is a leading African payment tech firm based in Nigeria that provides payment infrastructure, solutions, and services. Our mission is to empower everyone everywhere to do more by simplifying payments. We offer multi-channel payment options and comprehensive financial solutions, including utility payments, P2P payments, B2G and B2B payments, and invoicing, all while adhering to global security standards. Remita offers payment processing for the retail, government, and corporate sectors while fostering financial inclusion for the unbanked and underbanked populations.

Challenges

The adoption of Generative AI can be daunting, given the rapid pace of innovation and the overwhelming hype surrounding AI. Our approach at Remita is strategic and methodical. We began by evaluating our existing solutions and identified opportunities to infuse the intelligence of Large Language Models (LLMs) to enhance efficiency and intelligence. Our primary objectives were clear: improve user experience, bolster fraud detection capabilities, expand industry collaboration opportunities, and enhance internal operational efficiency across the enterprise.

One of the areas we identified for improved user experience was the struggle some of our customers have with locating the right service to pay for on our platform. Additionally, we realized that finding information about our products and services could be made easier for users, and developers wanted to be able to leverage our APIs in a more user-friendly way.

Remita’s Generative AI Use Cases

To address these challenges, we started by introducing four key AI assistants and several AI agents designed to improve the user experience for customers on our platform.

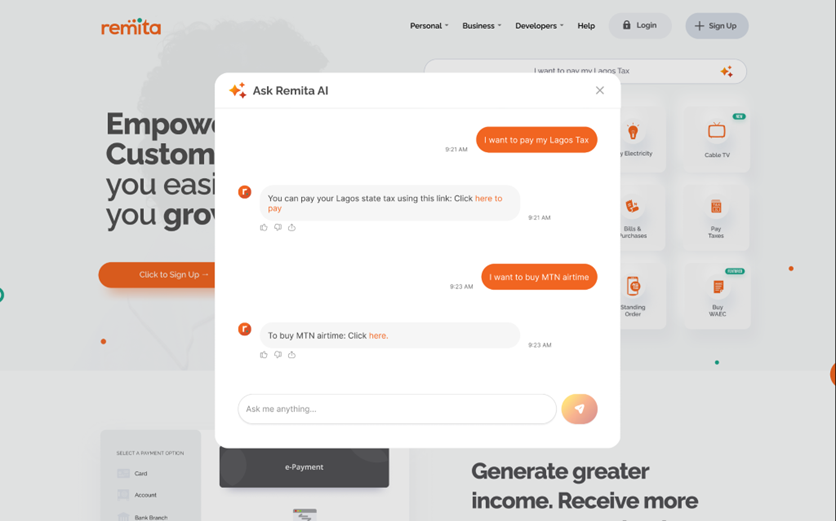

- Payment Assistant: Streamlines the payment process by generating a payment link for any payment type through conversational interactions. Customers no longer have to navigate a long list of merchants and services; they can simply ask the assistant for what they want to pay for and receive a direct link for payment completion. This significantly improves the customer’s journey and enhances the overall user experience.

- Product Knowledge Assistant: Answers any question about Remita’s extensive offerings, and offers tips on how to maximize the potential of the Remita platform. Customers can easily access information about our offerings and receive insights into how our products and services can support their diverse requirements.

- Developer API Assistant: Acting as a copilot for developers integrating our APIs, this Assistant has been trained with our API specifications and can answer all API-related queries. It also generates code snippets in any programming language for our API endpoints, which developers can easily integrate into their projects. This accelerates the integration process by over 50%, reducing time to market for our customers and ecosystem partners.

- Confirm Receipt Assistant: Leveraging an AI vision model, this assistant helps merchants validate the authenticity of Remita receipts presented by customers. By allowing merchants to take a picture of the receipt, the Assistant uses an in-built agent to confirm its validity, helping reduce instances of fake receipts.

AI Agents: We have embedded several AI agents within these four Assistants to support customers in performing actions efficiently. Some of these agents include:

- Resend Receipt Agent: Designed for customers who need access to historical payment receipts on Remita by providing access to a conversational interface that asks basic validation questions and forwards payment receipts to their mail inboxes.

- View My Balances Agent: Designed for registered users, this Agent provides quick access to all user account balances across different banks on a single screen with ease.

- Transaction Report Agent: This Agent enables registered customers to have a report or statement of their recent transaction generated and made available to them through a conversational interface.

Figure 1.0: Remita’s Product Knowledge Assistant In Action

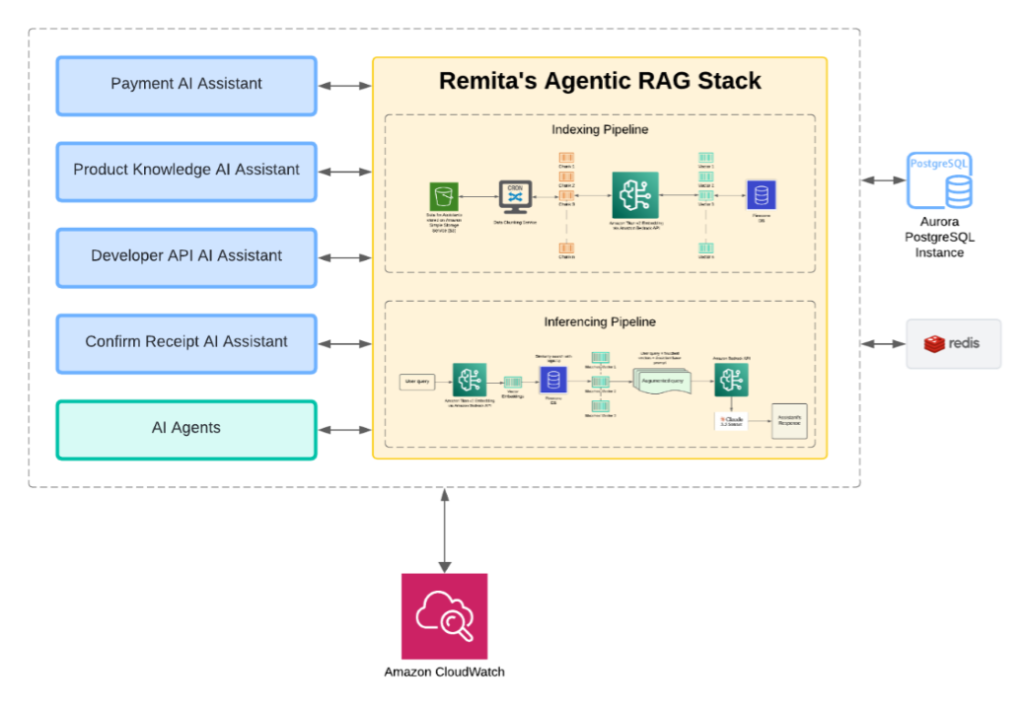

Remita’s Generative AI High-Level Architecture

To ensure a robust foundation for rapid scaling, we developed an Agentic Retrieval-Augmented Generation (RAG) solution from the ground up. This solution includes a training pipeline, an inference pipeline, and an LLM Orchestrator connected to several leading commercial and open-source LLMs, such as Claude 3.5 Sonnet, Llama 3.1 405b, and GPT-4o. These are accessed through providers like Amazon Bedrock, OpenAI, Anthropic, and Groq

With this Agentic RAG solution, we can deploy new AI assistants, train them, and attach AI agents within minutes. Each assistant can be configured to utilize any preferred LLM for AI inferencing, giving us both control and scalability in an ever-evolving AI landscape.

Figure 1.1: Remita’s High-level Architectural Model

Architectural Challenges and Guardrails

It is established that in these early days, Generative AI stacks come with their own set of challenges. Issues such as hallucinations, output bias, and prompt injections are still prevalent in LLMs. To mitigate these concerns, we employed some prompt engineering techniques and data fine-tuning. High-quality, exhaustive data is crucial for reducing hallucinations and ensuring the success of AI projects. Additionally, we built a feedback mechanism into our AI assistants to detect and proactively address hallucinations.

By utilizing the N-shot prompt engineering technique, we effectively tackled most cases of prompt injections and jailbreaks, ensuring that the Assistants were used exclusively within Remita’s context.

Early Trial Results with Customers

Our private beta results have been overwhelmingly positive, with customers expressing satisfaction with the improved user experience on the Remita platform. The feedback we received was invaluable and has been incorporated into the latest version of our AI solutions. We will continue to monitor and refine our AI capabilities to deliver the best possible service to our customers.

Next Steps

Looking ahead, we are developing an AI-powered transaction management, fraud detection, and mitigation system. By fine-tuning AI/ML models, we aim to predict and score transactions in real-time, before they are processed. Additionally, we are working on a customer support first-responder AI agent to intercept and address support requests autonomously, which we believe will reduce our customer support team’s workload by over 60%.

We are also adopting Generative AI across the enterprise to improve operational efficiency and generate intelligent insights

Conclusion

The Generative AI revolution is almost two years old, and its global impact continues to grow at an amazing pace. Despite the hype, businesses worldwide are still utilizing only a fraction of the capabilities of LLMs and AI agents. The race for Artificial General Intelligence (AGI) and the competition between open-source and commercial AI models are driving advancements at an astonishing speed. Companies that fully embrace Generative AI across their product and service offerings will be the ones to thrive in the next few years.

AI regulation is still lagging, as there is no one-size-fits-all approach to AI governance. Regulations vary across sectors, such as finance and medicine, and much work remains to align safety standards globally. Both the UK and the US have instituted AI Safety Boards to address these challenges and we are hopeful Nigeria will speedily land its own version based on work we believe has already started in this direction.

For businesses yet to embark on their AI transformation journey, there is no better time than now. Start by enhancing your existing solutions with Generative AI and build from there.

You can learn more about Remita’s transformative AI journey by visiting remita.net to have a feel of our AI solutions and services.

Further reading: For more technical details on design and architecture click here

About the Author

Uchenna Okpagu is the Chief AI Officer at Remita Payment Services Limited. A Certified AI Scientist with over 20 years of experience in building technology and fintech solutions at scale, he is at the forefront of driving Generative AI innovation at Remita.