In addition to addressing individual financial needs, Remita offers solutions tailored to businesses and corporate entities through her corporate profile feature.

On the Remita login page, users encounter two distinct profile types:

- Personal

- Corporate

This article delves into Remita’s corporate profile functionality, exploring its purpose, use cases, benefits, and the range of corporate profiles available.

The corporate profile serves as a specialized account designed to meet the requirements of organizations, businesses, and governmental entities. Upon successful creation, each organization gets a unique Organization ID, essential for accessing Remita’s corporate features.

All corporate profiles can create services directly within their profile, allowing customers to make payments for these services and facilitating receipt of payments through their Remita account. Services offered can encompass a wide range, including tangible and intangible products.

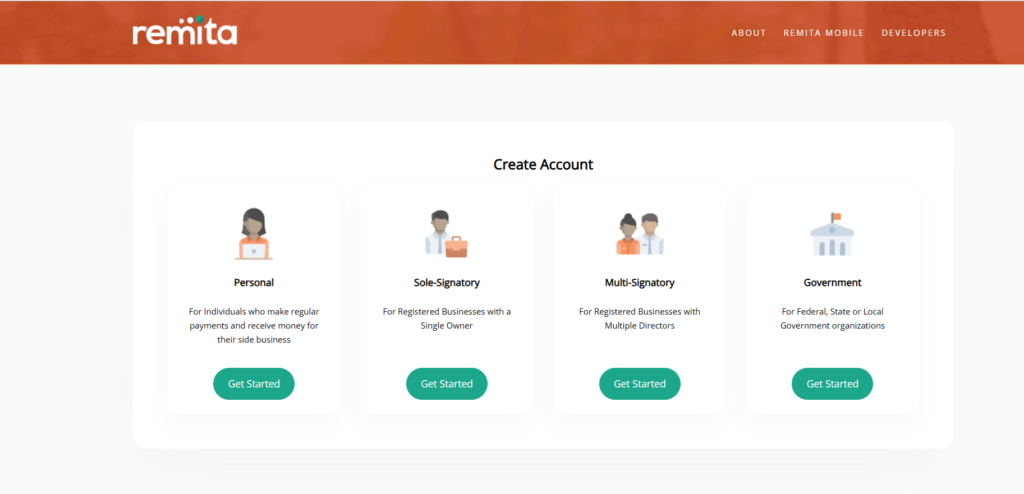

Remita has three types of corporate profiles cater to the needs of different businesses and corporate entities. The types of corporate accounts are available on the Remita signup page, where companies can choose the type that best suits them.

Remita signup page

- Sole-Signatory

- Multi-Signatory

- Government

Sole-Signatory Accounts

A sole-signatory account within the corporate profile category permits only one authorized signatory (user) to manage the account. This account type is particularly suited for small businesses seeking to conduct payment transactions, receive payments, and offer specific services to customers via the Remita platform.

A sole-signatory account directly deposits payments into the user’s Remita profile upon transaction completion. Organization IDs for sole-signatory accounts typically commence with the letter “S” followed by numerical digits.

To initiate the creation of a sole-signatory account, navigate to the signup page and select the sole-signatory account option. As expected, complete the required fields with the necessary business information for this account type.

Multi-Signatory Accounts

A multi-signatory account falls within the corporate profile category, enabling multiple users to operate the account. This type of account offers flexibility by including numerous signatories, with no limit to the number of users that can be added.

Organization IDs for multi-signatory accounts typically start with the letter “C” followed by a sequence of numerical digits.

Within this account type, users typically fall into two categories:

- The Initiators

The initiators start the payment process by documenting who will be paid, what service or product they are being paid for, and the amount to be paid. Once this is done, it is passed on to the other category of users.

- The Approvers

The approvers finalize the transactions, and the account in use is debited while the beneficiaries are credited.

It is important to note that in this type of account, various categories of users can be added or created as deemed fit by the organization; however, the minimum is two, playing the roles seen above.

Government

A government profile is a specialized account type tailored for government agencies such as ministries, non-departmental public bodies (NDAs), state governments, and similar entities. Identified by organization IDs beginning with the letter “G” followed by a series of numerical digits, this account type is specifically structured to meet the unique requirements of government institutions.

How to create a corporate profile

To create a corporate profile, follow these steps:

- Go to the Remita signup page.

- Choose the profile type that aligns with your needs.

- Complete the provided form with relevant details.

- Check your email for further instructions.

- Make a note of your Organization ID for future reference.

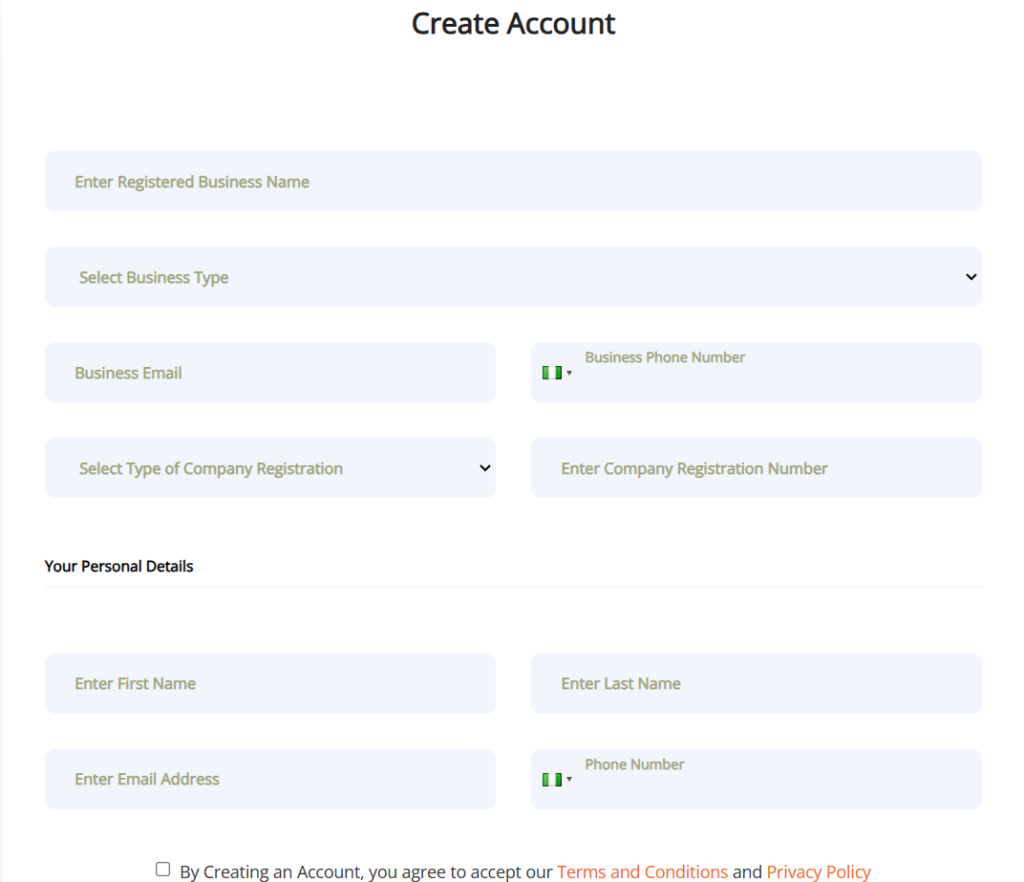

For both sole-signatory accounts and multi-signatory accounts, the account opening form is the same as seen below:

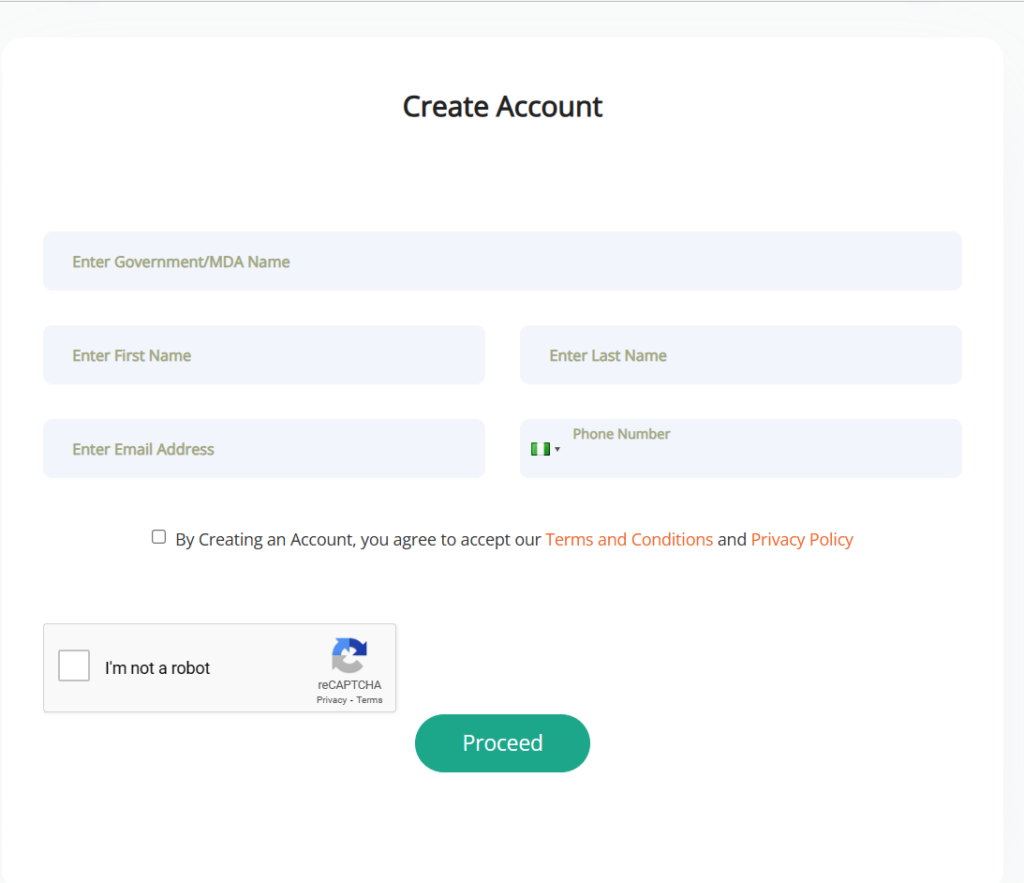

For government account types, the account opening form is different and needs a different set of information, as seen in the image below:

Conclusion

The Remita account opening process is streamlined, accessible, and swift, ensuring a hassle-free experience. Whether you’re opening a personal, corporate, or government profile, rest assured you’ll gain access to exceptional financial services. Take the first step today by signing up with us!