Day two of the Nigeria Fintech Week (NFW) kicked off with great energy! The first day had been a resounding success, featuring our CTO, Mujib Ishola, along with other key personalities in a fireside chat about Africa’s Tech in the Age of AI.

On Day 2, we were once again out and about in bright orange colors, making meaningful connections, engaging with a diverse audience passionate about the future of payments, and learning from top leaders in the industry.

The day started with a keynote address titled The Role of Smart Regulation in Positioning Africa’s Fintech Ecosystem to Accelerate Inclusive Growth, delivered by Dr. Aminu Maida, Executive Vice Chairman of the Nigeria Communications Commission. In his address, Dr. Maida defined smart regulation as regulation that was adaptive, responsive, and collaborative, recognizing the unique needs of a rapidly evolving market and adjusting accordingly. He reaffirmed the Commission’s commitment to effective regulation and the protection of all stakeholders involved. He also emphasized the importance of collaboration, even among various regulators, to move the economy forward.

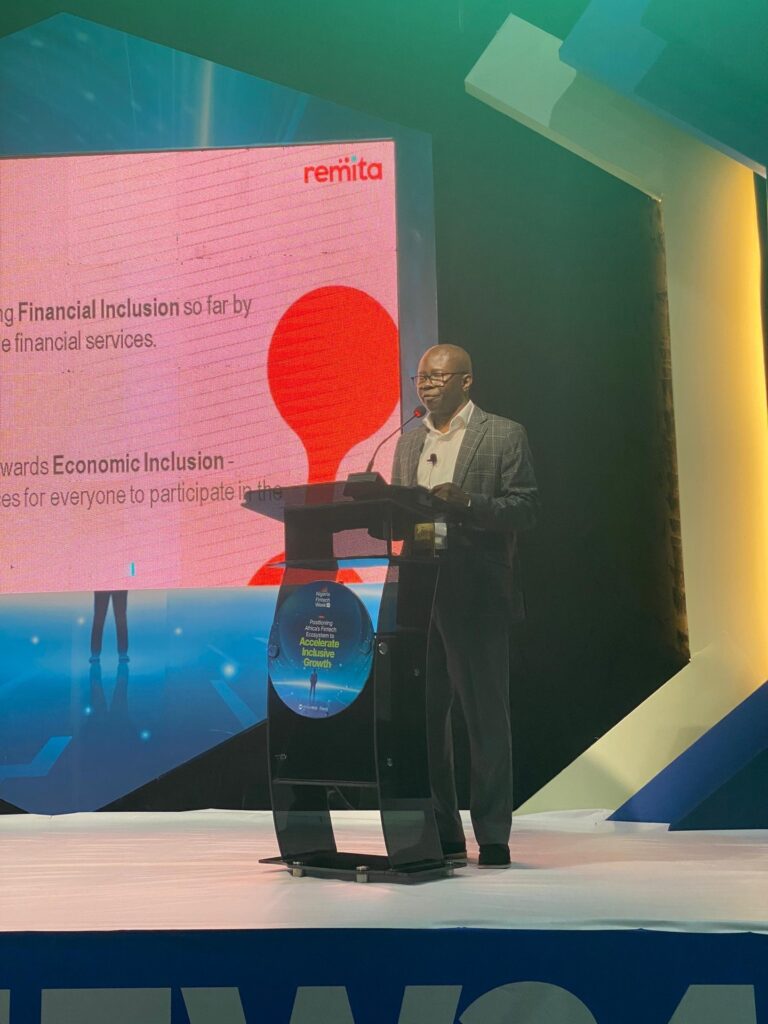

In addition to learning from and connecting with various stakeholders, industry players, and enthusiasts, one of the highlights for us was the keynote address delivered by our Managing Director, ‘Deremi Atanda. His speech, titled From Financial to Economic Inclusion: The Fintech Ecosystem Connection, explored the progress made in financial inclusion in Nigeria and emphasized the need to now focus on economic inclusion. According to him, although significant effort and funding had gone into the financial and fintech space, it had not yet translated into economic growth, as the nation’s GDP per capita was on the decline compared to neighboring countries.

Mr. Atanda introduced the Connect campaign, which encouraged everyone to actively participate in promoting economic inclusion, not just by discussing policies but by ensuring those policies deliver the intended benefits. He urged fintech players to see themselves as part of a community with a social impact, where strong business numbers would ultimately contribute to economic growth.

He also outlined five key areas, or levers, where the fintech ecosystem could rally efforts:

Tech talent – Providing internal platforms for upcoming talents to learn from key industry players in fintech.

Digital assets – RemitaConnect, a platform that allowed everyone to distribute digital assets and earn revenue. The platform aimed to democratize digital assets, with anyone able to connect through APIs.

Sustainable finance – The company’s commitment to corporate governance and ESG initiatives.

Public digital infrastructure – Collaborating with regulators and other stakeholders to develop innovative payment infrastructures for emerging business models.

Digital inclusion – Offering new solutions that empower the creator economy and adjacent ecosystems.

In his closing remarks, Mr. Atanda summarized his address as a call for collaboration, encouraging all players in the fintech industry to identify their roles in fostering inclusive growth in Nigeria and across the continent.

“Digital inclusion only happens when the digital infrastructure is available, reliable, and affordable,” said ‘Deremi Atanda.

Day 3 promised to be another exciting day, with opportunities for further learning as our Managing Director, ‘Deremi Atanda, is set to be inaugurated as a Member of the Governing Council of the Fintech Association of Nigeria.

Venue: Landmark Event Center, VI, Lagos.

Date: 8th – 10th of October, 2024.

Time: 10:00 a.m.