In today’s digital-first economy, payment gateways serve as the linchpin of modern commerce, enabling secure, seamless, and efficient monetary transactions. This article dives deep into the world of payment gateways, explaining their architecture, functionality, challenges, and future trends to help readers at all levels understand their importance and how businesses can leverage them for optimal online payment systems.

Who Should Read This?

- Business owners and entrepreneurs seeking to implement online payment systems.

- Developers and technical professionals involved in payment gateway integration.

- Finance and IT professionals exploring secure transaction methods.

- Students or enthusiasts aiming to understand digital payment infrastructures.

- Familiarity with online transactions and e-commerce.

- An understanding of basic technical terms (e.g., APIs, encryption, authentication).

Understanding Payment Gateways

A payment gateway is a secure digital infrastructure that authorizes and processes online transactions between customers and merchants. It ensures that sensitive payment information, such as credit card numbers, is transmitted securely to prevent unauthorized access.

Core Functions:

- Transaction Authorization: Ensuring the customer has sufficient funds.

- Data Encryption: Protecting sensitive data during transmission.

- Fraud Detection: Identifying and mitigating fraudulent activities in real time.

- Payment Routing: Forwarding transaction data to the acquiring bank for processing.

Key Components:

- Merchant Account: Holds funds before transfer to the business account.

- Payment Processor: Routes transaction data between gateway and banking networks.

- Encryption Protocols (SSL/TLS): Secure communication between customer and server.

- Tokenization: Replacing sensitive data with unique tokens.

Types of Payment Gateways

When selecting a payment gateway for your business, it’s crucial to understand the different types available and how they align with your needs. Below is an in-depth overview of the major types of payment gateways, their features, advantages, and challenges.

1. Hosted Payment Gateways

In this model, customers are redirected to a third-party payment provider’s platform to complete their transactions.

- How it works: Once customers are ready to pay, they are taken to an external page managed by the payment provider. After completing the payment, they are redirected back to the merchant’s website.

- Advantages:

- Simplified Compliance: The payment provider handles PCI DSS compliance and other security measures, reducing the merchant’s liability.

- Pre-built Security Features: Advanced fraud detection and encryption are typically included.

- Disadvantages:

- Limited Control: Merchants have minimal influence over the checkout experience, which may lead to inconsistencies in branding and user engagement.

- Potential Drop-offs: Redirecting users to a third-party site can result in cart abandonment.

2. Self-Hosted Payment Gateways

With self-hosted gateways, merchants manage the payment process directly on their website.

- How It Works: Customers enter their payment details directly on the merchant’s website, and the payment data is transmitted securely to the gateway for processing.

- Advantages:

- Complete Branding Control: Businesses can design a fully customized checkout process that aligns with their brand.

- Enhanced User Experience: Seamless integration into the website eliminates the need for redirection.

- Disadvantages:

- Compliance Complexity: Merchants must adhere to strict PCI DSS standards and maintain robust security protocols.

- Higher Maintenance Costs: Additional resources are required to ensure ongoing security and functionality.

3. API-Based Payment Gateways

These gateways allow developers to integrate payment processing capabilities directly into a website or app using APIs.

- How It Works: Developers use the gateway’s APIs to build a custom payment solution tailored to the business’s specific requirements.

- Advantages:

- High Flexibility: Offers extensive customization options, enabling businesses to create unique payment experiences.

- Developer-Friendly: APIs are designed for seamless integration with existing systems.

- Disadvantages:

- Technical Expertise Required: Implementation demands skilled developers.

- Maintenance Responsibility: Merchants must manage updates and ensure ongoing security compliance.

4. Localized vs. International Payment Gateways

- Localized Gateways:

- Focus: Support region-specific payment methods (e.g., REMITA).

- Advantages: Tailored to local preferences, improving user trust and conversion rates.

- Disadvantages: May lack support for international payments.

- International Gateways:

- Focus: Enable cross-border transactions with support for multiple currencies and international payment methods.

- Advantages: Essential for businesses targeting global markets.

- Disadvantages: This can involve higher fees for currency conversion and cross-border processing.

5. Hybrid Payment Gateways

A hybrid model blends features of both hosted and self-hosted gateways, offering flexibility for businesses with diverse needs.

- How It Works: Part of the payment process is handled on the merchant’s website, while sensitive transactions are offloaded to a secure third-party platform.

- Advantages:

- Balanced Approach: Combines the security benefits of hosted gateways with the branding control of self-hosted options.

- Scalability: Suitable for businesses looking to transition between hosted and self-hosted models.

- Disadvantages:

- Complex Setup: Requires careful planning to integrate the dual approach effectively.

- Variable Costs: Hybrid models can incur mixed fees depending on usage.

By understanding these gateway types, merchants can make informed decisions based on their business goals, technical capabilities, and customer needs. Whether prioritizing simplicity, flexibility, or scalability, selecting the right payment gateway can significantly impact overall user experience and operational efficiency.

Key Features of a Good Payment Gateway

- Support for Diverse Payment Methods: Credit/Debit cards, digital wallets, BNPL (Buy Now, Pay Later), and Cryptocurrency.

- Security: Implementation of PCI DSS standards, fraud detection tools, and tokenization.

- Multi-currency Support: Facilitates international transactions.

- Integration Options: APIs, SDKs, and plugins for various platforms.

- Scalability: Handles high transaction volumes with minimal downtime.

- Detailed Analytics: Insights into transaction trends and customer behaviour.

How Payment Gateways Work

Technical Overview:

- Encryption and Tokenization:

- Customer data is encrypted using SSL/TLS protocols.

- Tokenization replaces card details with a secure token for processing.

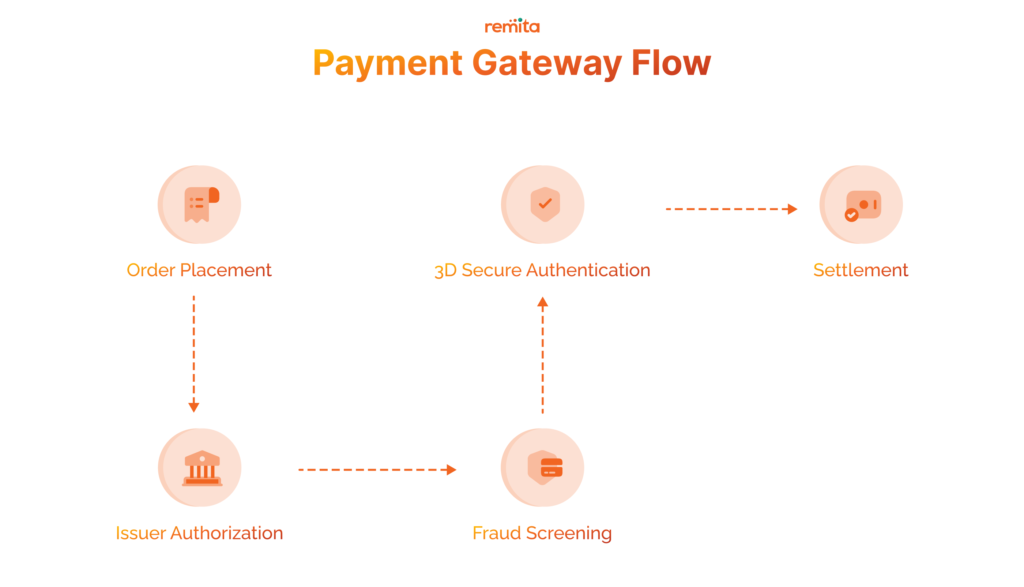

- Step-by-Step Process:

- Customer Order Placement: Payment details are entered on the merchant’s site or gateway page.

- Authorization: The payment gateway forwards data to the processor and issuing bank.

- Fraud Screening: AI-based tools validate the transaction.

- Authentication: Banks use 3D Secure protocols for added verification.

- Settlement: Funds are transferred from the customer’s account to the merchant’s account.

Role of Middleware and APIs:

Middleware bridges the merchant’s application and the gateway, ensuring seamless communication.

Benefits of using Payment Gateways

- Data Protection: Prevents unauthorized access through encryption and fraud detection.

- Enhanced UX: Supports seamless checkout with minimal friction.

- Recurring Payments: Ideal for subscriptions and memberships.

- Global Reach: Enables businesses to expand internationally with multi-currency transactions.

- Real-Time Monitoring: Tracks and resolves transaction issues instantly.

Challenges and Risks

Implementing and managing a payment gateway involves navigating several challenges and risks that can impact both business operations and customer satisfaction. Below is a detailed exploration of these potential obstacles:

1. Technical Integration Challenges

- Complexity in Configuration: Setting up a payment gateway often requires intricate configurations, including API integrations, compatibility checks, and testing across multiple platforms.

- Impact on Workflows: Poor integration can lead to disruptions in order processing, delays in payment confirmation, and a subpar user experience.

- Customization Challenges: Businesses aiming for a tailored checkout process may face additional technical hurdles, requiring skilled developers and advanced tools.

2. Data Security and Breach Risks

- Cyber-Attack Vulnerabilities: Payment systems are prime targets for hackers, with risks ranging from phishing attacks to sophisticated data breaches.

- Customer Trust Impact: A breach can result in the loss of sensitive payment details, leading to reputational damage and customer attrition.

- Need for Advanced Security Measures: Implementing encryption, tokenization, and fraud detection mechanisms is essential but adds to operational complexity and costs.

3. Regulatory and Compliance Requirements

- Regional Variations: Compliance with regulations like GDPR (General Data Protection Regulation) in Europe or PCI DSS (Payment Card Industry Data Security Standard) globally requires businesses to navigate diverse legal landscapes.

- Constant Updates: Evolving regulatory requirements demand continuous monitoring and adjustments to payment systems, which can strain resources.

- Non-Compliance Penalties: Failure to adhere to these regulations can result in hefty fines, legal actions, and loss of operating licenses.

4. Transaction Failures and Operational Issues

- Network Instabilities: Payment failures due to downtime or connectivity issues can frustrate customers and lead to lost sales.

- Declined Transactions: Legitimate payments may be erroneously flagged as fraudulent, causing customer dissatisfaction and additional workload for support teams.

- Settlement Delays: Operational inefficiencies or system lags can prolong the transfer of funds to merchant accounts, affecting cash flow.

5. Adapting to Emerging Payment Trends

- Changing Consumer Preferences: With the rise of digital wallets, cryptocurrencies, and buy-now-pay-later (BNPL) options, staying relevant requires businesses to adapt quickly.

- Technology Upgrades: Regular updates to accommodate new payment methods can be time-consuming and expensive.

- Customer Expectations: Modern consumers demand seamless, fast, and secure payment options, placing pressure on businesses to innovate continuously.

Future of Payment Gateways

As technology continues to advance, the payment gateway landscape is evolving to meet growing demands for security, efficiency, and convenience. Innovations such as AI-powered fraud detection, blockchain transactions, and frictionless cross-border payments are redefining how businesses and consumers interact with digital payments.

Remita is at the forefront of this evolution, providing businesses with secure, scalable, and future-ready payment solutions. Whether you’re looking to simplify collections, automate payouts, or enhance transaction security, Remita ensures you’re always ahead in the fast-changing world of digital payments.

Below is an in-depth look at key trends shaping the future of payment gateways:

1. AI in Fraud Detection

Artificial intelligence (AI) and machine learning are revolutionizing fraud prevention by providing real-time, data-driven insights.

- How It Works: AI algorithms analyze transaction patterns to detect anomalies and flag suspicious activities.

- Benefits:

- Enhanced fraud detection accuracy.

- Reduced false positives, improving customer experience.

- Continuous learning allows the system to adapt to new threats.

2. Blockchain Integration

Blockchain technology offers a decentralized and highly secure framework for processing payments.

- Key Features:

- Tamper-Proof Transactions: Immutable ledgers ensure transaction records cannot be altered.

- Transparency: Real-time visibility into payment flows for all stakeholders.

- Lower Costs: Reduced reliance on intermediaries decreases transaction fees.

- Potential Use Cases: Cryptocurrency payments, cross-border settlements, and smart contracts.

3. Token-Based Authentication

Tokenization is becoming a cornerstone of secure payment systems by replacing sensitive data with unique, non-reversible tokens.

- Advancements in Security:

- Biometric Integration: Use of facial recognition, fingerprints, or voice authentication alongside tokenization.

- Dynamic Tokens: Tokens that expire after a single transaction, minimizing data exposure.

- Impact: Reduced risk of data breaches and greater customer trust.

4. Real-Time Payments (RTP)

Real-time payment systems are designed to provide instant settlement and fund availability for transactions.

- Features:

- Speed: Transactions are processed and settled within seconds.

- Accessibility: Available 24/7, removing delays caused by traditional banking hours.

- Use Cases: E-commerce, peer-to-peer (P2P) payments, and business-to-business (B2B) transactions.

- Impact: Improves cash flow for businesses and enhances customer satisfaction.

5. Open Banking

Open Banking is reshaping financial ecosystems by enabling seamless integration between banks, businesses, and third-party applications.

- How It Works: Through APIs, businesses can directly access banking services such as payments, account information, and lending.

- Advantages:

- Eliminates Intermediaries: Direct bank-to-merchant transactions reduce costs and improve efficiency.

- Personalized Services: Facilitates tailored financial solutions for customers based on their transaction data.

- Fosters Innovation: Encourages competition among financial service providers to offer better products.

Conclusion

In today’s digital economy, payment gateways play a crucial role in enabling secure, seamless, and efficient transactions. Choosing the right gateway requires businesses to assess their technical capabilities, operational needs, and customer expectations. By leveraging innovative payment solutions, companies can enhance user experience, build trust, and accelerate growth.

Take your business to the next level with Remita —Nigeria’s leading payment gateway. Whether you need secure collections, seamless disbursements, or automated payment processing, Remita offers a robust, scalable, and feature-rich solution designed to empower businesses of all sizes. Get started with Remita today and experience effortless transactions like never before!